Whether your company is merchandising, manufacturing, or service-based, keeping track of your production costs is vital. To optimize your total output and expenditures, you need to understand and track marginal cost and revenue.

Whenever a company increases its production, there is always an increase in production costs that must be recognized. Marginal and variable costs consider these increases and determine the optimal amount of units or labor required to keep production costs as efficient as possible.

We have already covered the importance of tracking variable costs within your organization. Now we will discuss the importance of marginal cost and marginal revenue and why they are critical concepts in managerial accounting.

Importance of Marginal Cost

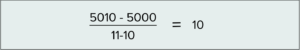

Marginal cost refers to the additional cost to produce each additional unit. In other words, this cost shows the increase or decrease in the cost of making one more item in production. The formula for calculating marginal cost is below:

For example, if the cost for a company to produce 10 units of a product or service is $5,000, and the cost to build 11 units is $5,010. In this case, the marginal cost for that additional unit is $10.

Marginal cost plays a crucial role in an organization, especially when a company must decrease its costs. Fixed costs are constant regardless of production levels; higher production leads to a lower fixed cost per unit as the total expenses are allocated across more units.

The marginal cost of production includes all expenses not fixed. For example, if a company needs to buy a new piece of equipment to produce more units, this is a marginal cost. The marginal cost varies according to the volume of the products constructed.

Marginal Revenue

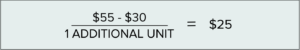

Marginal revenue (MR) is essentially the opposite of marginal cost. MR is the increase in revenue that results from the sale of one additional unit of product and is calculated by dividing the change in the total revenue by the difference in the quantity.

While marginal revenue can remain constant over a certain level of production output, it follows the law of diminishing returns, which states that any production increase will result in smaller increases in output. It means the company has surpassed its optimal level.

Example: A lava lamp business brings in $30 in revenue by producing its first lamp. Initially, its marginal revenue will be $30. If the same company makes a second unit and brings in another $25 in revenue for a total of $55, then the marginal revenue gained from that additional unit is $25.

Over time as the demand for lava lamps increases, output increases, and eventually, there will be a point when the business incurs more significant variable costs. For example, if the company is now producing 1,000 lava lamps per day, they eventually need to hire extra staff to package or run quality control checks. Thus the marginal revenue decreases to $23, then $22. The curve begins to slope upward when operations become less efficient and profitability decreases.

Working Together

Both marginal cost and marginal revenue work in tandem to help businesses set their output target in production. These two metrics are adjusted as production costs fluctuate. The ultimate goal is maximum profitability when marginal cost and marginal revenue are equal.

If marginal revenue were greater than marginal cost, then that would mean the company can continue making more units until the marginal cost is higher than marginal revenue. As we discussed previously, this diminishing returns point is where the company is losing money in producing more units and should scale back on output or increase the sales price.

Although having a high marginal revenue over a long period is not always a good thing, this discrepancy shows that the company is continually not meeting its customer demand.

On the other hand, when marginal revenue falls below the expected value, it is important to conduct a market analysis to determine the reason. Possibly there are too many competitors saturating the market, or the market trend for the product has peaked. Either way, the cause must be revealed in order to prepare for the next steps.

Conclusion

Every organization must focus on increasing revenue and net income to improve profitability. Therefore, businesses need to concentrate on how each sale affects the bottom line to produce stable sales revenue flows. To do this, you must track marginal revenue and marginal cost.

Ultimately, analyzing these two numbers and how they impact each other is critical to maximizing your profit, optimizing your team’s performance, and overall your company’s productivity.

Now that you are familiar with marginal cost and marginal revenue, it is time to put this into action. Signup for a FINSYNC free trial to experience financial harmony with your business.