Learn how to use FINSYNC to track project profitability in real time so you can ensure a healthy profit margin.

By FINSYNC

Tracking individual project profitability isn’t an easy task. Many projects stretch over months and involve the efforts of multiple people. It can be difficult to keep track of bills and expenses, even when you’re using some of the best project management software on the market.

Let’s assume you run an IT consultancy. You’ve been tasked with building a new website for a client who has a budget of $15,000. You have back-end and front-end developers in-house, but you will need to hire a freelance graphic designer and copywriter. You will also have many small, out-of-pocket expenses, such as web hosting, domain name and payment provider plug-ins.

How are you going to make sure that you achieve a solid profit margin?

Get Real-Time Profitability Updates with FINSYNC

The first instinct of many small business owners is often to use Excel spreadsheets to manage their projects. But how do you keep track of employee timesheets, freelancer invoices, and out-of-pocket expenses for various projects? An Excel spreadsheet will require manual daily updates, which only add more tasks to your already growing workload.

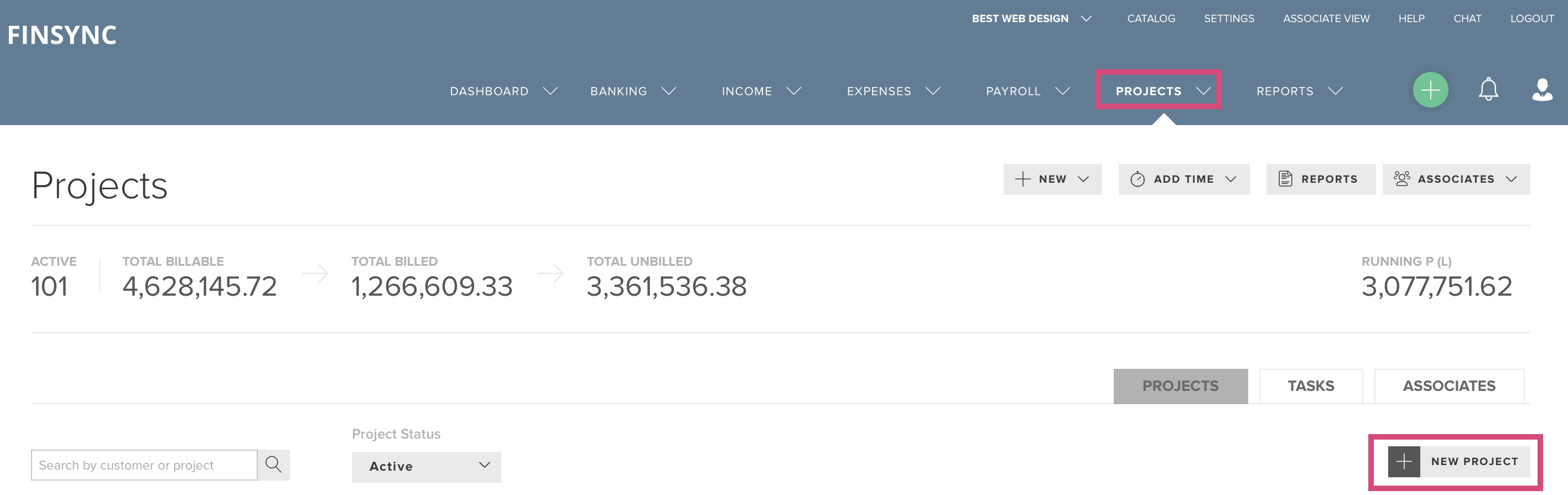

With project management software like FINSYNC, you can track the profitability of all of your projects by using the “Projects” feature. The Projects functionality is especially useful for businesses that do multiple long-term projects that have scheduled payments across the lifetime of the projects.

You can track the profitability of your next project in FINSYNC in five easy steps.

Step 1: Set Up a Budget

If you’ve been in business for a while, you might already have estimates for what it costs to build a new website from scratch. Still, it’s useful to ask your developers for estimates for the work specific to each project. It’s also a good idea to add a contingency on top of all your estimates to account for delays and changes in the scope of the project. If you don’t know how much contingency to add, 10% is a good rule of thumb.

Here’s how to create a new project in FINSYNC. Go to the PROJECTS menu, then select “NEW PROJECT”.

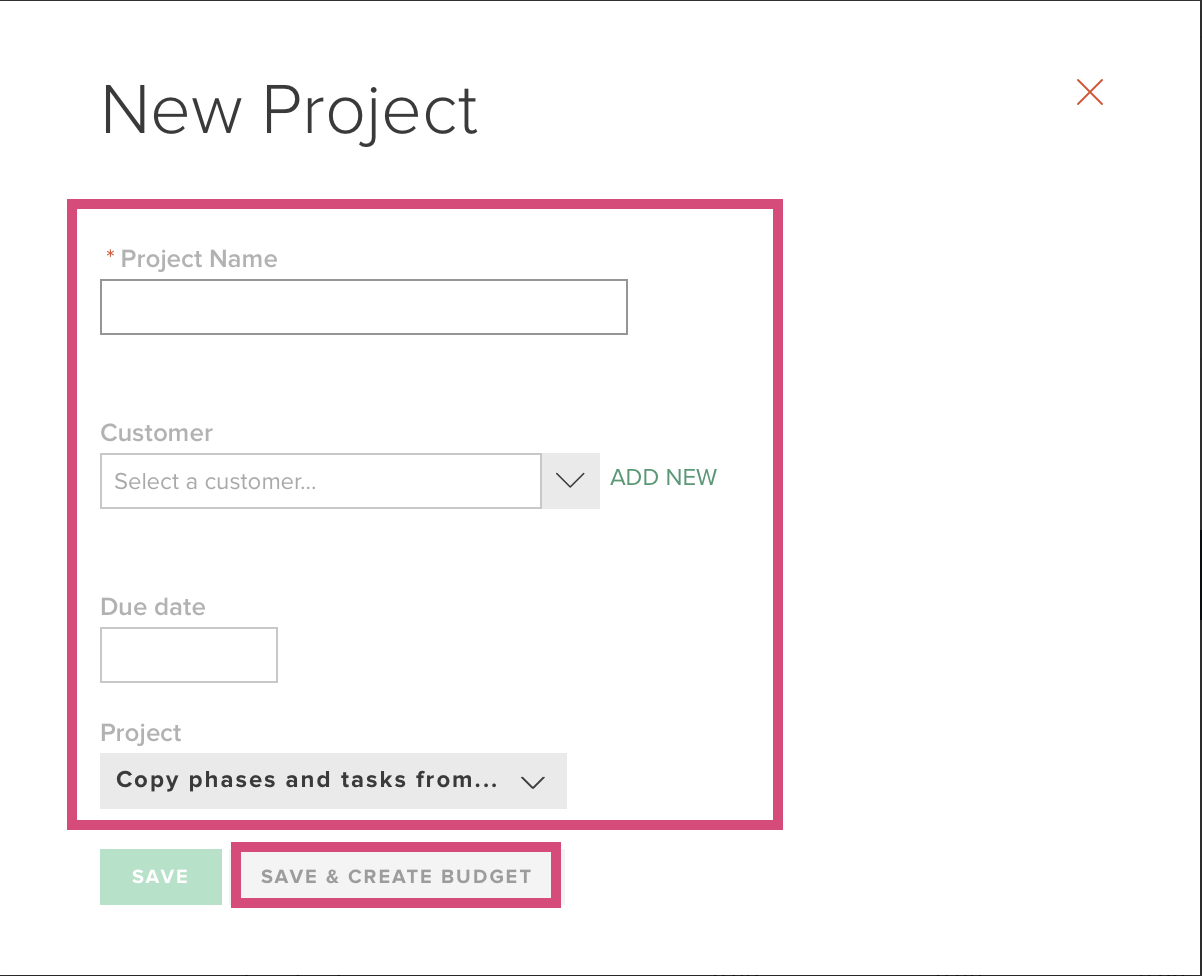

Fill out details and enter a budget amount for the project.

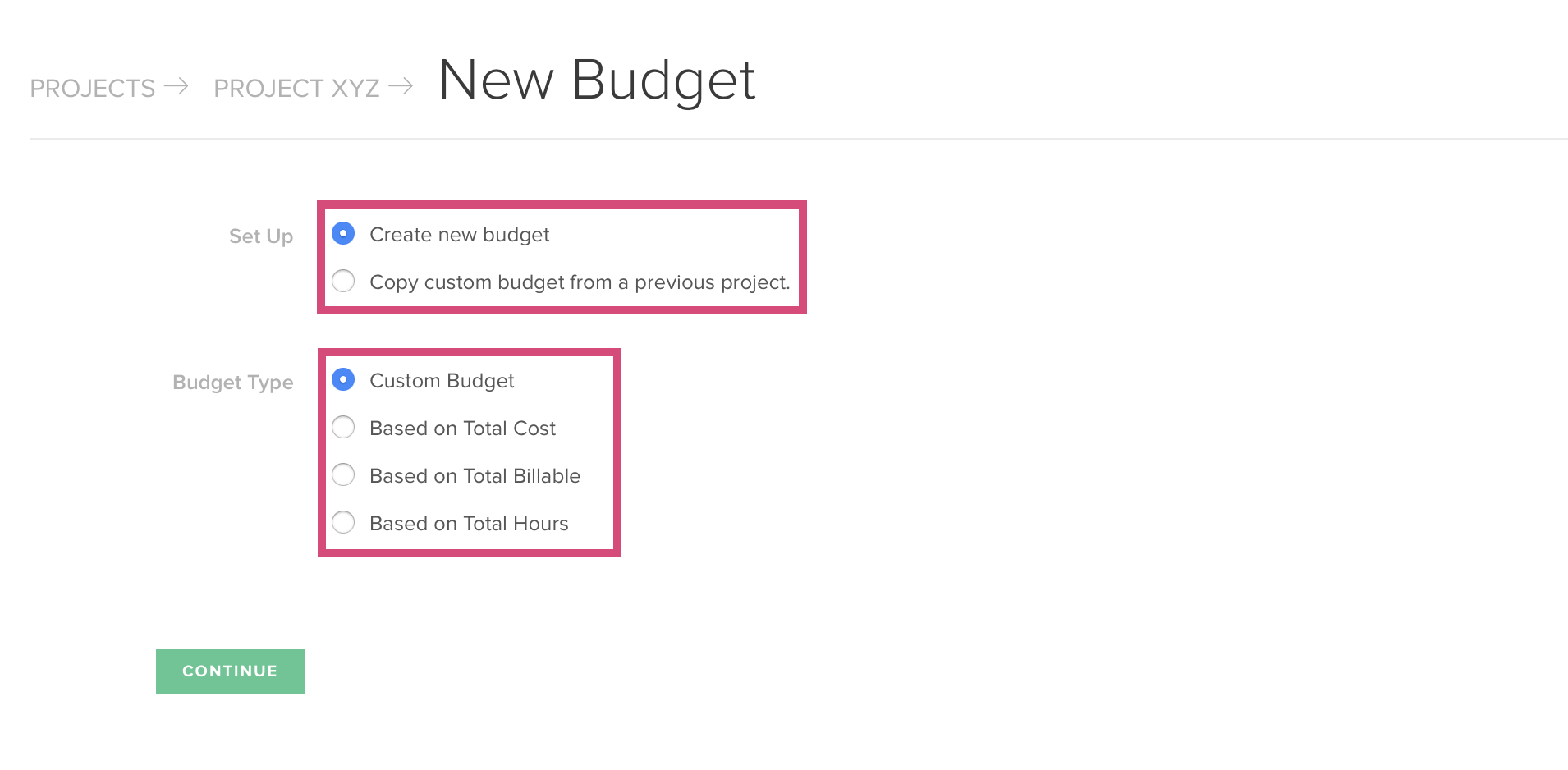

Now create a budget specific to that project.

For the website project, you would want to choose the “Based on Total Cost” option because you want to track how close you will come to the total budget. However, you can also track projects where there is no set budget, and all hours are billed after the project is complete. Or, you can simply track hours spent on a project.

Step 2: Set Up Milestones

Milestones, even if they are internal, are a great way to organize your long-term projects and track progress and profitability in greater detail. Milestones are referred to as “Phases” in FINSYNC. Each phase can represent a week, a month, or a specific task associated with the project.

For example, you can bill your website client, three times in the span of the project: once after your designer delivers the final mockups for the website, a second time after the front-end developers implement the designs, and finally when the back-end team finishes coding the rest of the website.

It can be useful to return to your budget from step 1 and set up the same milestones here as in the budget.

Step 3: Set Up Tasks Under Each Milestone

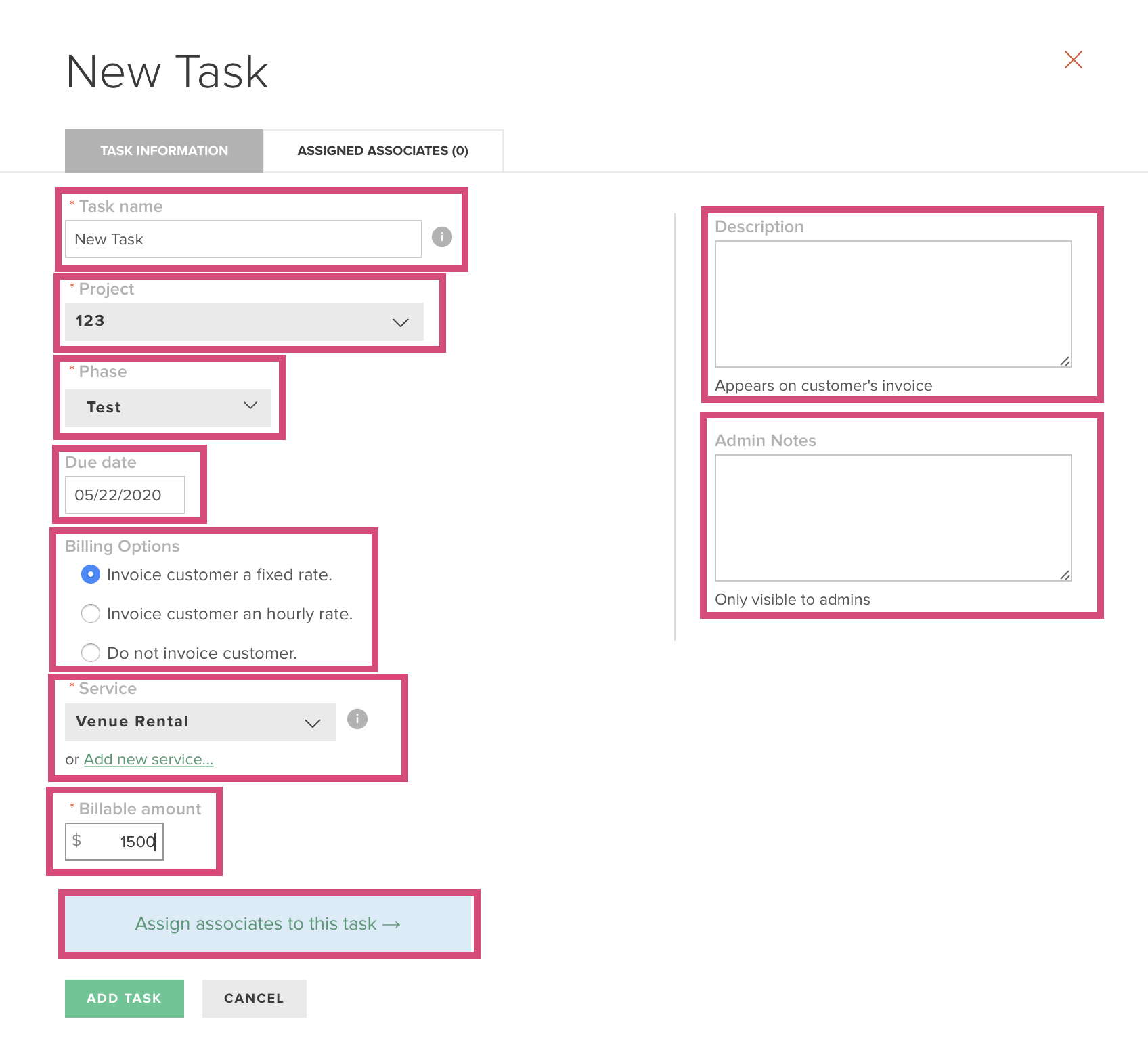

Each milestone you’ve set up in Step 2 can be broken down into specific tasks that can be assigned to a person.

There is no lack of project management tools out there, but the benefit of using the built-in task manager in FINSYNC is twofold. First, your employees and contractors will always know the next task they should be working on. As a result, less time is wasted on emails and calls.

Second, you’ll be able to see which tasks are billable, the true cost of each task, whether the tasks are completed on schedule, and how each task impacts the overall profitability of the project.

Step 4: Give All Project Participants Access to Track Time

As mentioned earlier in this post, you can assign each task from Step 3 to your employees and freelancers and invite them to track their time. When they do, the cost of the project will be automatically adjusted. You’ll need to be signed up for FINSYNC Payroll to benefit from this feature.

Step 5: Track Out-Of-Pocket Expenses

You will inevitably have expenses beyond labor that are input by your employees and freelancers. Perhaps your web developers need to upgrade an existing tool, or a contractor bills you a fixed sum for a service they delivered for the project instead of tracking their time in FINSYNC. With FINSYNC, you can pay all of your business expenses using your credit card, even vendors who don’t take credit cards.

All of these and other expenses can be easily linked to your project. You can either add a new bill or edit one that you have already received in your bills inbox.

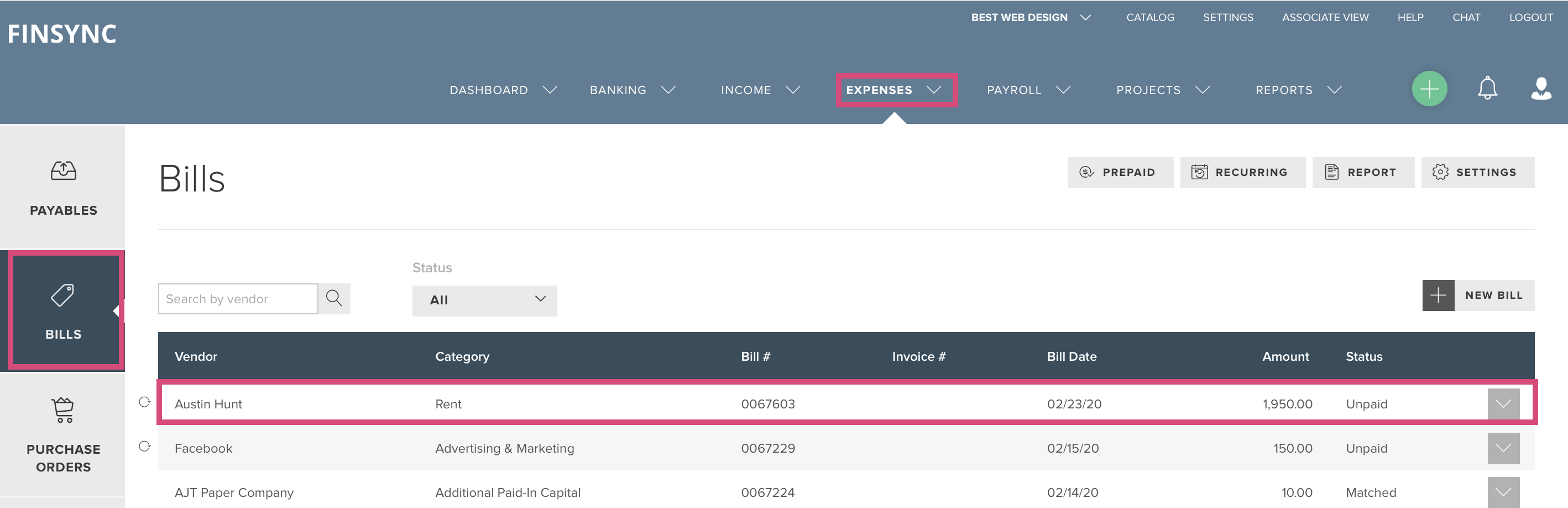

First, select a bill.

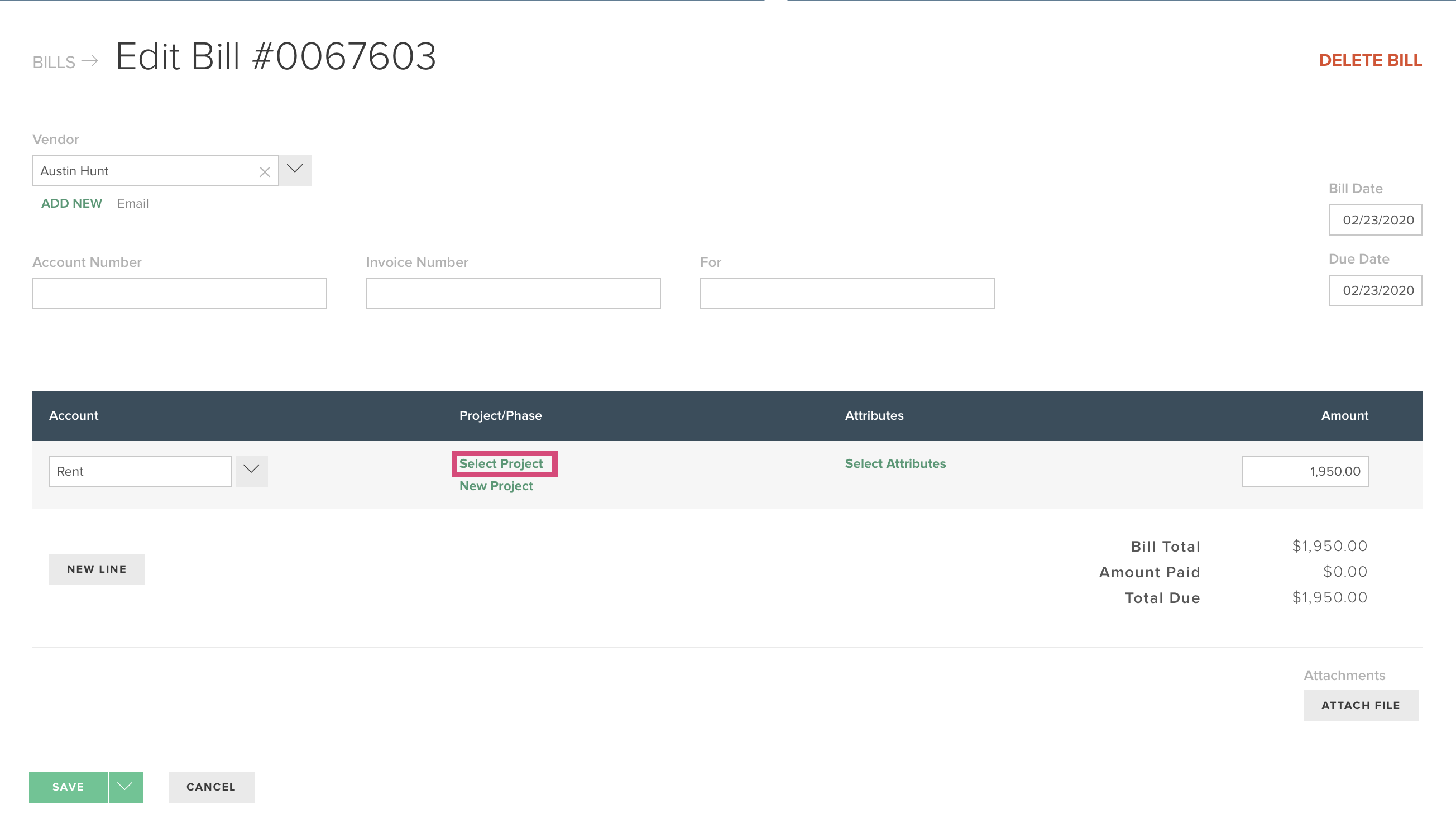

Next, add it to the project.

Insight for Future Projects

Once the project is complete, you can evaluate the profitability of your project against your budget. The division of the project into milestones and tasks makes it easier to see what worked and what didn’t so you can make adjustments for the next project. You can see the profitability of each individual phase.

Track your next project in FINSYNC and get real-time insight into your projected profit margin and where you actually end up.